Before we can discuss Baby Boomer Retirement Facts, I need to give you information about this generation. Then we need to discuss the problems that they face today, including the way financial industry deals with the average income earner. Finally, I will offer some solutions about what we as baby boomers can accomplish.

The Baby Boomer Generation

Baby boomers were born between 1946-1964. The oldest of them, born in 1946, reached retirement age in 2011. The youngest will reach retirement age at 2029. There are currently around 80 million baby boomers in the United States.

The Problems they Face

First, Baby boomers are expected to live longer than the previous generation. As a result, they face anxiety and stress due to worrying about retirement. Because they will live longer, they will need more retirement savings to support them through their retirement years.

Second, They need to care for their aging parents who are in their late 70’s to early 90’s. This provides another financial strain on their retirement savings as they may need to use some of it to care for their parents.

Those baby boomers, that were born on the tale end of that generation may still have children of school age who expect them to pay for their college. So, it looks like the youngest of the generation will have to care for their aging parents and their own children’s education’s needs.

Third, the older baby boomers are facing health problems of their own. As a result, they may face financial burden for medical problems. And as health care costs rise, they will be faced with that added expense.

They Are Not Prepared for Retirement

According to business insider in a recent article survey, they found that only 54% of baby boomers had any retirement savings at all. Out of those that do have savings, only 23% believe that they have enough to take care of them through retirement. Staggering Numbers! Out of the almost 80 million baby boomers, less that 10 million have money for their retirement. 70 million baby boomers will have to rely on government social security and/or help from their children.

Are those 10 million really prepared?

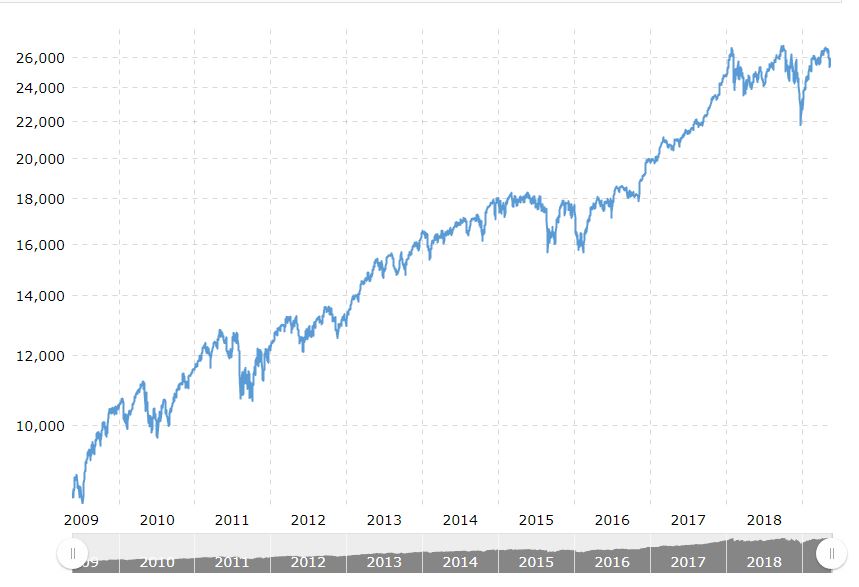

Today, the stock market is at the highest its ever been. As baby boomers worked through their lives, they were told by everyone to just put your extra savings in a 401k, that will get you through retirement. What happens if the stock market crashes or falls dramatically just before you decide to retire? If your 401k was susceptible to stock market risk, your retirement just lost a huge piece of its pie. Would you still have enough savings to retire comfortably?

The Problems with a 401k

At age 59 1/2 the IRS allows you to take up to 10% of your 401k without the 10% penalty. Although, in most cases, you are still required to pay taxes from that withdrawal. (See your accountant for tax advice concerning this matter if you have any questions) At 70 1/2, the IRS places more restrictions and penalties on your 401k. You are required to withdrawal 10% of your 401k every year or you will receive a penalty of 50% on that amount! The calculation is complicated and if you don’t do it right, you are penalized for it. If you would like to know how much you have to withdraw, you can check HERE to go to the FINRA* website.

*FINRA is not part of the government. they are a not-for-profit organization authorized by Congress to protect America’s investors by making sure the broker-dealer industry operates fairly and honestly.

The Financial Industry

The big financial companies like Goldman Sachs, and Morgan Stanley, cater to the elite 1%. That leaves 99% of the population without expert financial advice. If you do not have money, they do not want to do business with you. Both require at least $1 million cash to have your investments actively managed by a broker. Where does that leave the average person?

So Who is helping all these people who do not have enough to get the financial advice to retire without worry?

The Solution

The first step in preparing baby boomers and their succeeding generations is Education and Awareness. Business Insider stated in their survey that out of the 54% of baby boomers that had retirement savings, only 40% of those had even tried to calculate how much they even needed to retire. Do you know how your money works?

Take the HowMoneyWorks Challenge HERE

Education and Awareness

Understanding The rule of 72 is pivotal in being able to see how your money can work for you. Basically the earlier you start saving the greater your retirement savings will be. The question now is where do you save your money?

The Baby boomer generation was taught to save by putting part of your check into a 401k through your work, pay your expenses and the rest into a bank account. Well, talk about bad advice. According to the FDIC, the banks average interest rate is 0.09%. So if you had $10,000 in a saving account, it would take you 800 years to double your money. Great Advice! How much do you think the bank makes on that $10,000 you just gave them?

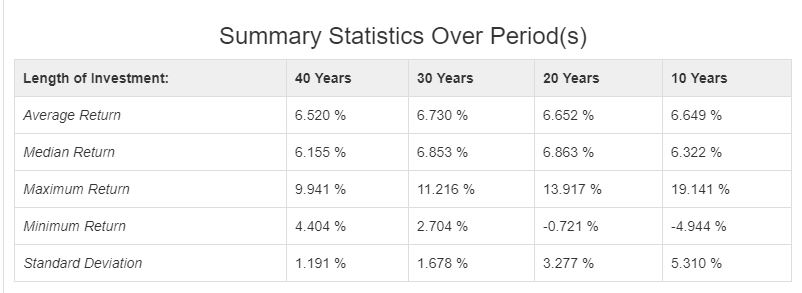

Since we cannot count on making any real return on our investment in a bank, a lot of baby boomers invested in the stock market. What do you get when you invest in the stock market? Risk, and anxiety, If you believe the stock market is headed for another crash like it did in 2008. Since 2009, the stock market over 40 years has averaged 6.5%. And that does not include what you pay in taxes.

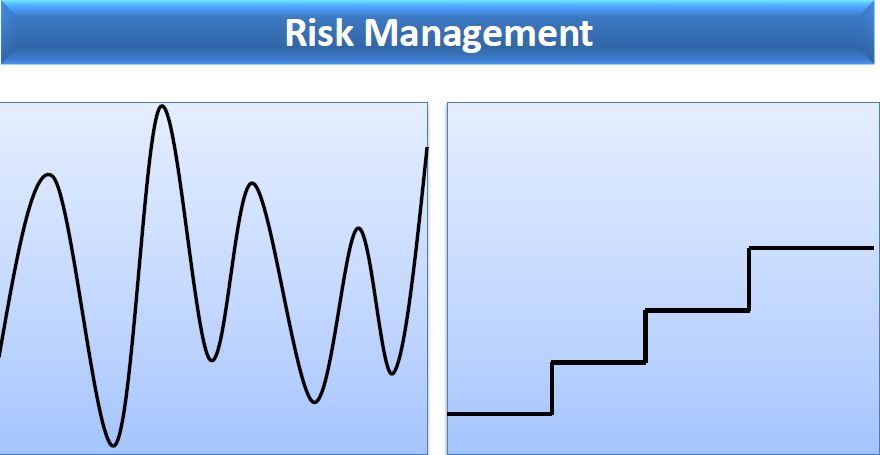

These figures are the avg returns. As you can see from the above graph, the market fluctuates up and down daily, weekly and monthly. What happens when you need to retire when the market just lost 5, 10 or even 20%? Do you have time to wait for it to rise as it invariable did in the past?

Types of Investments for Retirement

Taxable

98% of People in the U.S. Make less that $250,000. Where do you think they put their money? If your thinking Banks, you are right. That is what most people think. So we know savings accounts yield about 0.1%, Money Markets yield around 1% and CD’s around the same. So they are getting a real low rate of return and they get taxed on whatever it yields. Not looking too good.

Tax Deferred – 401k

Above, you got a glimpse of the 401k. To summarize, your risk is tied to the stock market so if you want higher returns, then you have the higher risk. This is okay for the Millennials, or GenXer’s who have time to watch the ups and downs of the market. But Baby boomers are at that point in their lives where they would like the high returns but are not willing to take the risks associated with it. They do not want to lose what they have. When they reach retirement age and start taking their required minimum distributions, they will taxed on that income. They need another option…

Tax Advantaged

Roth IRA is one option. You will not be taxed on any of the earnings because it is pre-taxed money. But there are a few restrictions. First, if you are a couple make over $203,000 and are married filing jointly, you cannot invest in a Roth IRA. 2nd, if you make under that, you are limited to the amount you can invest. For 2019 its $6000/yr or $7,000 if you are over 50 years old. 3rd, depending on where you invest the Roth IRA, it could still be susceptible to market loss. 4th, There are no required minimum distributions, like a 401k.

If you are thinking maybe I can convert my 401k to a Roth IRA. You would have to pay taxes on the conversion amount equal to your tax bracket. And if you pay for the taxes from the conversion amount, you just took a big chunk out of your retirement savings.

Another option for a tax advantaged plan is getting certain life insurance policies. I know, that sounds strange..How can I save for retirement with life insurance? That won’t help me, because the only way to collect is when I die. My kids will get it, but it doesn’t help me.

Indexed Universal Life Insurance (IUL)

This is a life insurance policy that will protect your family in case of your death. Because there are certain advantages it also offers a vehicle to save money and collect interest without risk to the owner.

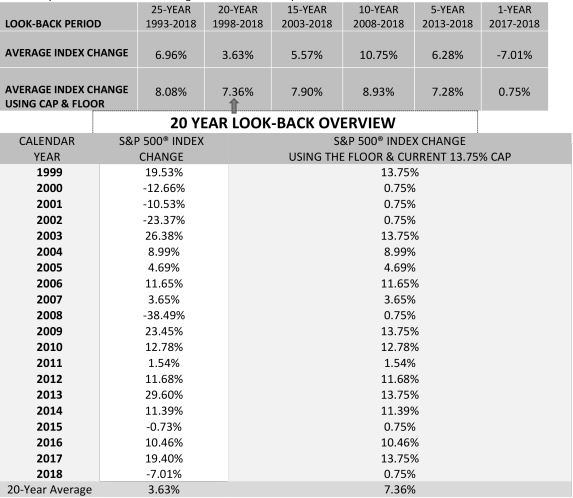

The way it was explained to me is that any money that you put into your insurance policy beyond the premium payment earns interest. With an Indexed account, depending on what the policy states the floor and the cap is,your interest varies. Generally, your interest earned is no less than 0% and no more than 15%. Which means that your earned interest is not “in the stock market”, so there is no risk. The insurance company pays you interest based on an index of the stock market, but is not part of it. As a result, if the stock market loses 10% that year on average, your return would have a floor of 0%, not -10%. But if the market goes up 20% for that year, you would only earn at the 15% cap. Over the last 20 yrs, the avg return for an IUL is about 7.4%, which is higher than your return from a 401k without the risk.

IUL vs. S&P 500 avg return

The Left side is average 20 year return from the S&P 500 Index, 3.63% rate of return, On the right, using a floor and a cap, you can see that the rate of return is 7.36%. Just looking at the fluctuation of the Index over the years is scary. What would your portfolio look like if you wanted to retire in 2008? Losing 38% of your 401k is a heavy loss, thousands of people were prevented from retiring then. So do you have time to wait another 10-15 years for the market to adjust if it crashes again?

401k returns would look like the graph on the left, the right would show your returns from an IUL. So one solution for baby boomers is getting into a financial vehicle that offers indexed returns with no chance of loss.

Income Potential

An IUL Financial Vehicle also offers a way to collect income from that policy when it’s time to retire. Since the income you are collecting is borrowing from that policy, there is in most cases no taxes you have to pay. If it is a good IUL, the process would charge you interest on your money, but using accounting techniques consistent with government regulations, you would in reality not be charged for using your own money. Although the amounts you take out could possibly affect the death benefits that your heirs receive later.

Still doing research….more to come….

If you are interested in a profitable business opportunity that is designed to help families attain their financial goals and security in retirement, then check out my Information Page HERE for a great way to make extra money part time.

You can also check out my Financial Website HERE. Watch the Video “Dreams Start Here”. Plus if you look around on the site, There are more informative facts that will help you with any retirement decision making.

Rodney Primanti

CA State License #0L42688